So what is going on in the Northern Ireland, and wider UK property market and are we getting the full story on Rising House Prices in Northern Ireland and Falling Property Sales ?

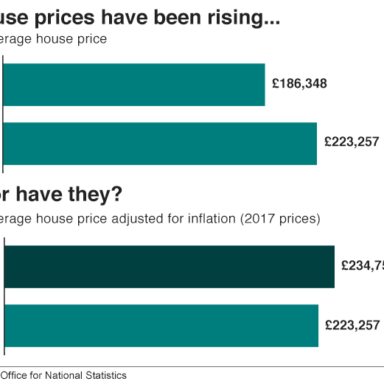

Inflation Has Risen Faster Than House Prices

Whilst rising house prices sounds like positive news, align this with the growing costs of living and the story looks somewhat different. Data suggests that UK inflation has risen faster than house prices in the last decade therefore when you compare the average house price in 2017 and adjust for the changes in inflation since 2007 it depicts a fall, rather than a rise.

House Prices Vary Regionally

The earnings versus outgoings battle has been an ongoing struggle for younger generations trying to get onto the property ladder for the first time, which led to the introduction of Help to Buy schemes in recent years. The BBC highlight a massive regional divide across the UK which has seen London house prices rise by almost 70% in the last decade, whereas house prices have fallen by over 40% in Northern Ireland over the same period. Average deposits for first time buyers in England, Scotland and Wales have risen much faster than incomes, thus making it harder to save the thousands of pounds required for a deposit. Things look very different in Northern Ireland though. Northern Ireland appears to buck the trend with deposits dropping 19 times faster than incomes. Meaning getting onto the property ladder in Northern Ireland at a time of Rising House Prices in Northern Ireland and Falling Property Sales is much easier for first time buyers here as it is in the rest of the UK.

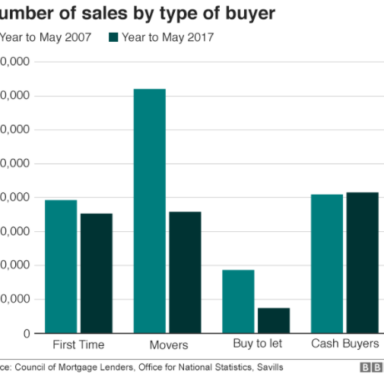

Falling Property Sales

The falling number of property sales appears to be prevalent across most buyer groups. The majority of buyers are purchasing less than they did a decade ago – as much as 30% less. The drop in ‘first time buyers’, although significant is not as pronounced as the drop in the number of ‘movers’ and ‘buy to let’ buyers, which have more than halved in the last decade. Only a slight increase in ‘cash buyers’ has been noted.

So why are movers and buy to let buyers not buying anymore?

There are lots of factors contributing to Rising House Prices in Northern Ireland and Falling Property Sales , but some of the most frequently cited reasons include the following:

- More People Forced to Rent

Faced with difficulties getting onto the housing market, more would-be owners have been forced to opt for renting as an alternative.

- High Stamp Duty

A review of historic stamp duty rates shows that stamp duty was 0% on houses up to a value of £125,000 in 2008 and 1% on houses valued greater than £125,000 and up to £250,000.

Since 2014 stamp duty on the latter has been 2%. The difference in stamp duty rates becomes more prohibitive on higher value properties.

Positive changes have been made in recent months however. The Chancellor’s autumn budget revealed that zero stamp duty would not be charged to first time buyers on homes up to the value of £300,000, and a rate of 5% will apply to first time buyers whose purchase is over £300,000 and up to £500,000. It is estimated that 80% of first-time buyers will benefit from these changes. The maximum saving under the new scheme would be £5,000, but this would only apply to homes valued at the highest end of the scale.

There are also some clauses to note. For example:

- These changes in UK stamp duty apply in England, Wales and Northern Ireland, but not Scotland.

- A first time buyer is deemed to be someone who has never before owned property anywhere in the world, therefore it excludes those who have not bought property but have inherited it.

- It also excludes first time buyers who are buying to let as the property must be your main residence.

Its remains to be seen whether such changes will help to increase the number of houses purchased by first-time buyers.

- Home Buyers Favoured Over Landlords

For the past decade those buying a home to live in have been favoured over landlords buying to rent. Tax breaks such as higher rate tax relief on mortgage interest and the wear and tear allowance that equated to 10% of the annual rent value are no longer allowed and have contributed to the reduction in buy to let buyers in the UK.

Calculating your taxable profit is also challenging as HMRC rules mean that not all expenses associated with the upkeep of your rental property can be claimed. Costs must be deemed to have been incurred wholly and exclusively for the purposes of the letting business and must not be deemed as capital expenses i.e. costs to upgrade the property and increase its value.

- Lack of Housing Stock

In many areas the cost of upsizing is prohibitive and instead homeowners are investing in improving or extending their current homes rather than selling and buying elsewhere. New dwelling output remains low compared to pre-boom levels and more social housing development is taking place.

All of these factors creating Rising House Prices in Northern Ireland and Falling Property Sales make decision making challenging for buyers and sellers, property developers, and renters who wish to get onto the property ladder. If you would like to discuss your current situation with our property law team, or gain advice before making a decision to buy, sell or move, please feel free to contact us on 028 3026 7134 or email us to arrange an appointment.